When thinking of sending money to the Philippines, one can be overwhelmed with various information posted in the internet. There are different options available, from money remittance option to online bank transfers. But not all are ideal to us. It might not be a great deal of an issue to someone who will send money to the Philippines just once.

But, to a business owner who has offshored workers to whom he needs to send salary to in a monthly or bi-monthly basis. The factors such as the amount of processing fees, the length of time it takes before the money sent is received. And the hassles involved in sending the money play a vital role in choosing the right option.

Several business owners who have attended my 3-day business learning tour to the Philippines. have been amazed by the business opportunities available for them. Through engaging the services of diligent Filipino workers. It is understandable that you too might get a little too excited about the idea of hiring a Filipino virtual assistant.

Or an offshored accountant for yourself once you discover how much they cost. But the issue of getting the worker paid usually comes afterwards. Often with the offshored worker shouldering the disadvantages.

While fees associated with sending money abroad often play the main factor in the sender’s decision making. It is not always the case. Before you dwell into the question of “how much”, it is advisable to look into some other aspects of the sending and receiving experience. Below are some of the things you might want to think about before you decide to send your virtual worker’s hard earned salary:

Delivery Time

After sending the money, how long will it take before your worker in the Philippines receives it? As a responsible employer, you must take into consideration the span of time it would take before they receive it. Most Filipino workers do not have disposable income. Typically, Filipinos work to support their family. They help their parents pay for their sibling’s education expenses and household expenses.

This means that your offshored worker would be living from paycheck to paycheck. If your employment contract states that the employer will receive his salary every 30th of the month or every 15th and 30th of the month. You need to choose a money transfer option that takes just a couple of minutes to reflect on the worker’s account.

If the mode of payment you chose would take up to 3 days before your worker receives it. You might want to send your payment at least 3 days before the agreed date. Plan ahead. Otherwise, your offshored employee and his family may need to struggle financially for 3 days.

Proximity and Availability

Choosing online payment options like Paypal may seem to be the easiest and the fastest. But you need to think if it will be easy for the recipient. Most Filipinos do not have Paypal accounts because Paypal accounts needs verification. Paypal can only verify an account through credit cards.

Most Filipinos do not have credit cards. Why? Because most banks in the Philippines would only approve credit card applications from workers who have minimum wage of 15,000 pesos a month. That’s about A$111 a week. And it needs proof that they have a considerable amount of disposable income. Again, most Filipino workers do not have disposable income. If you choose other options such as Western Union or other money remittance services. It would be nice to ask your Filipino employee if the remittance center is close to their place.

Security and Reliability

This is money after all. It may not be much of an amount to you, but for your worker, that is a “lifeline”. Make sure to choose a money transfer option that is secured (for your information’s sake as well) and is difficult for thieves to get their hands on. Investigate the transaction path from sender to receiver to make sure that all agents involved are trustworthy.

Customer Service

While many money transfer and remittance options are secured, fast and reliable. It is always advisable to transact with a business that lends a helping hand in case problems arise. Make sure that the company you choose has good customer service that can assist you in the event of online and offline problems like delay or non-arrival of funds.

Fees

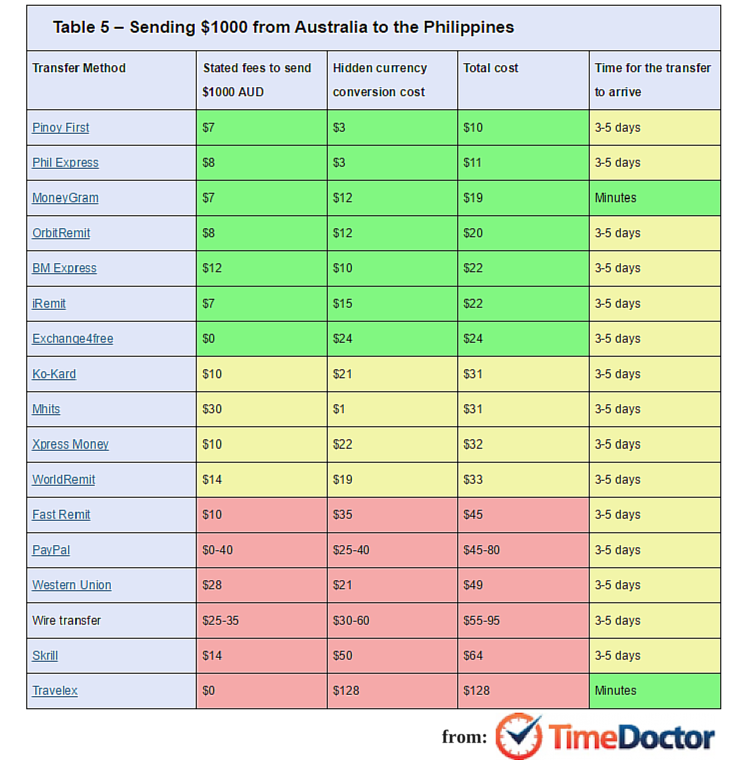

Considering the fees associated with sending money is something you should never forget. But, lower fees doesn’t always mean a good choice. Banks usually charge more, but they are trustworthy. You can check out this blog from Time Doctor. For a better look at the costs of sending money to the Philippines from different parts of the world.